Moving into a new house can be both exciting and overwhelming. To ensure a smooth transition and a comfortable settling-in process, here are some essential things to do before moving into a new house:

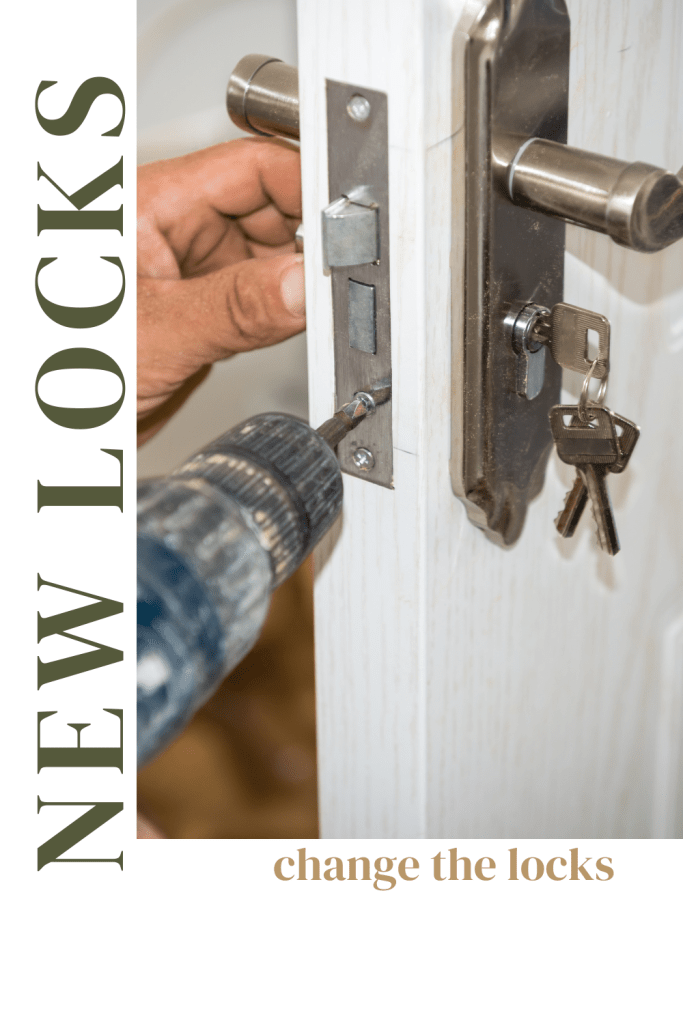

Change locks and security codes: For your peace of mind, replace the locks on all exterior doors and change any security codes for alarm systems. You never know who might have a copy of the old keys or codes.

Deep clean the house: Before unpacking your belongings, give the house a thorough cleaning. Scrub floors, wipe down surfaces, clean appliances, and wash the windows. This will make the space feel fresh and welcoming.

Paint and do minor repairs: If you plan to paint the walls or do any minor repairs, it’s easier to do so before moving in. This way, you won’t have to move furniture around or worry about protecting your belongings.

Set up utilities and services: Contact utility companies to ensure water, electricity, gas, and internet services are set up and ready before moving in. Also, schedule service providers like cable, internet, and telephone. Click Here

Measure and plan furniture placement: Measure the rooms and doorways to ensure your furniture will fit through them. Create a layout plan to know where each piece will go, making the unpacking process more efficient.

Change your address and notify important parties: Update your address with the post office, banks, credit card companies, insurance providers, and any other important organizations or subscriptions.

Update driver’s license and vehicle registration: If you’re moving to a new city or state, update your driver’s license and vehicle registration accordingly.

Set up a forwarding address: Arrange for mail forwarding from your old address to your new one. This will ensure you don’t miss any important mail during the transition.

Inform family and friends: Let your loved ones know about your new address and contact information, so they can stay in touch and visit you in your new home.

Learn about the neighborhood: Research the local amenities, schools, medical facilities, and nearby recreational areas. Familiarize yourself with the neighborhood to make the transition smoother.

Celebrate the new beginning: Moving into a new house is a significant milestone. Take some time to celebrate with your family and friends and enjoy the excitement of your new home.

By following these steps, you’ll be well-prepared and can enjoy the process of settling into your new home with ease.