Hurricanes can significantly impact the home-buying process, especially if you are close to closing on your dream home. The aftermath of a storm requires special attention, even if the house you’re purchasing seems unaffected. Here’s a checklist of things to do before closing on a house after a hurricane

1. Schedule a Post-Hurricane Home Inspection

One of the most important things to do is schedule a thorough home inspection, even if the house already passed one before the hurricane hit. Hurricanes can cause structural damage, water intrusion, and electrical issues that might not be immediately visible. Ensure that your home inspector pays close attention to the roof, foundation, windows, and any areas prone to flooding.

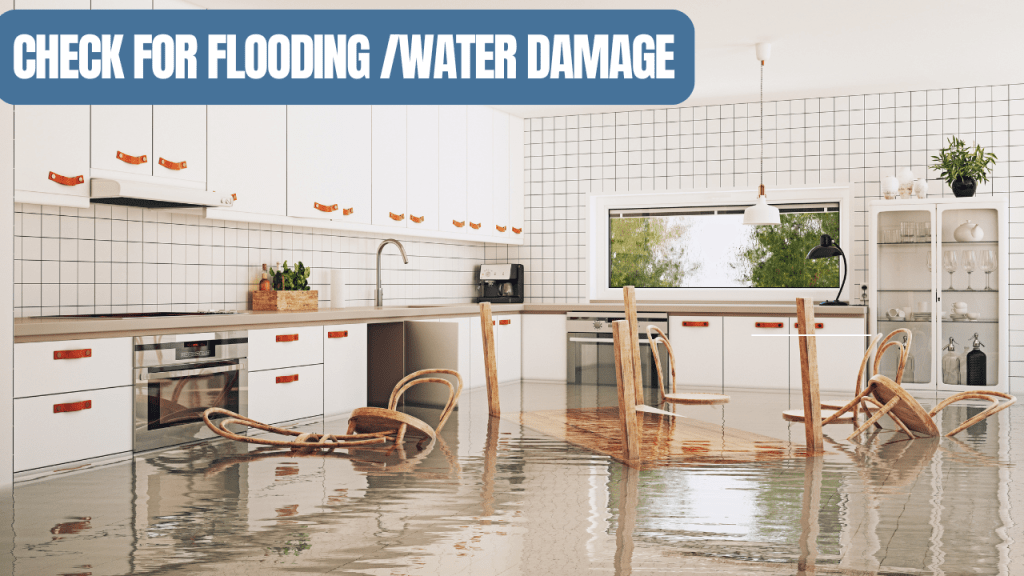

2. Check for Flooding or Water Damage

Even homes outside of designated flood zones can be affected by heavy rains and storm surges during a hurricane. Walk through the house and property to look for signs of water damage, such as:

Mold or mildew smells If you notice any issues, you may need a mold inspection or further evaluations from contractors specializing in water damage.

Damp or soggy areas in the yard

Water stains on walls, floors, or ceilings

3: Get Updated Appraisal

A hurricane may affect the property’s value, especially if the home has sustained damage or the surrounding area has been impacted. Ask your lender if an updated appraisal is required. An updated appraisal will ensure that the home is still valued appropriately for your mortgage and can protect you from overpaying if the market value has changed post-hurricane

4 :Contact your Lender

Contact Your Lender and Insurance Provider: Inform your lender and insurance company about the hurricane and any potential impacts. You may need to update your insurance policy or provide proof of a new inspection to ensure the property remains insurable and qualifies for financing. Some lenders may require a reappraisal or property condition report. After a hurricane, banks and lenders might experience delays in processing loans or updating appraisals. Keep an open line of communication with your lender and plan for possible delays in closing. It’s better to be flexible with your timeline than to rush through the process and miss crucial steps.

5: Review the Seller’s Disclosures Again

After a hurricane, it’s a good idea to request an updated seller’s disclosure. Even if the home was not damaged during the storm, the seller may need to report any changes to the property’s condition. This could include repairs made after the hurricane or any new issues that arose.

Discuss Any Necessary Repairs or Credits

If the home has been damaged during the hurricane, it’s crucial to negotiate repairs with the seller. This could involve:

- Asking the seller to make repairs before closing

- Negotiating a credit or reduction in the purchase price to account for the cost of repairs

- Working out an escrow holdback, where funds are set aside at closing to cover repairs after the sale is complete

Be sure to document everything in writing and consult your real estate agent and attorney to ensure all agreements are formalized.

Conclusion

Closing on a home after a hurricane requires extra vigilance, but by taking the right precautions, you can ensure that your investment is protected. Make sure to conduct a thorough post-hurricane inspection, review your insurance coverage, and negotiate any necessary repairs. These steps will help you avoid costly surprises and close with confidence.

If you’re a first-time homebuyer and need more guidance, feel free to reach out for expert advice. Protect your home and investment, especially when unpredictable weather strikes!

The Homebuyer Mentor, Turning Renters Into Homeowner